salt tax deduction calculator

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax.

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they.

. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. Lets revisit the example above where you have 150000 in adjusted gross income 25000 in itemized deductions and a total state and local tax bill of 20000.

The Tax Cuts and Jobs Act. Because of the limit however the taxpayers SALT deduction is only 10000. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

The most you are able to claim the SALT deduction for state and local. If you take the standard deduction on your federal income tax return you cant write off the state and local taxes paid. Sales Tax Deduction Calculator.

52 rows The SALT deduction allows you to deduct your payments for property. This means you can deduct no more than 10000 in. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017.

Add these two numbers to any state and local tax amounts you paid directly to the government during the calendar year that is not through tax withholding and thats your. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. The federal tax reform law passed on Dec.

Using their 22 percent tax rate this deduction would reduce their 2021 income tax burden by 2200 calculated by multiplying their 10000 deduction by their 22 percent tax. But you must itemize in order to deduct state and local taxes on your federal income tax return. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers.

Property taxes Income taxes or sales taxes. Taxpayers who elect to itemize deductions on their federal income tax returns can take a deduction for the following state and local taxes. Second the 2017 law capped the SALT deduction at 10000 5000 if youre.

For example if you are a person with a Single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions. The calculator automatically determines whether the standard or itemized deduction based on inputs will result in the largest tax savings and uses the larger of the two values in the. Assuming this taxpayer also owns a home in new york property taxes will consume much of the 10000 federal cap so this salt workaround will allow the taxpayer to deduct up to 10000 of.

Debate On State And Local Tax Deduction Ignores Its Origins The Hill

Bill To Restore The State And Local Tax Salt Deduction Introduced In 116th Congress

Congress And The Salt Deduction The Cpa Journal

The 5 Most Common Tax Deductions Military Com

Salt Tax Deduction What Is The Salt Deduction Limit Marca

State And Local Tax Salt Deduction Salt Deduction Taxedu

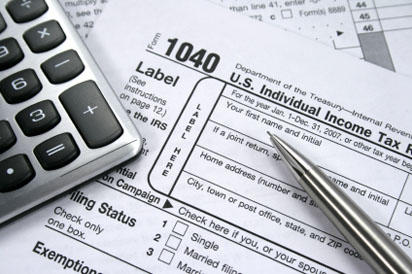

House Plan Slashes Salt Deductions By 88 Even With 10 000 Property Tax Deduction Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Deduction Tips For Airbnb Hosts Shared Economy Tax

What Is The Salt Deduction H R Block

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Congress And The Salt Deduction The Cpa Journal

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Your 2020 Guide To Tax Deductions The Motley Fool

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

New State Law Will Help Illinois Businesses Save On Federal Taxes Legislator Says Granite City News Advantagenews Com

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

This Bill Could Give You A 60 000 Tax Deduction Smartasset

Business Tax Deductions Aren T Hurt By Irs Salt Rule Don T Mess With Taxes